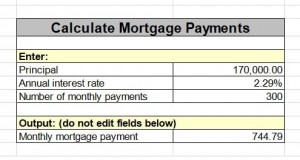

Work to pay down loans and decrease your overall debt. So check your credit report and make sure there are no inaccuracies - report any to the credit bureau. Two of the most important factors that determine your mortgage interest rate are your credit score and DTI. Looking for ways to save money on your monthly mortgage payment? Follow these tips: Improve your credit score and debt-to-income (DTI) ratio But as the total costs of homeownership add up - and add to expenses such as making payments on other loans, transportation, and entertainment - you’ll be glad you have an extra cushion of money in your monthly budget. So if you earn $7,500 per month gross, you should spend no more than $2,100 on housing. The result is the maximum you should spend on your monthly payment for housing (mortgage principal, interest, taxes, and insurance). Multiply your gross monthly income by 28%. Here’s a rule of thumb to help you get a sense of what kind of home you can afford. Many new homeowners are surprised to learn the true cost of owning a home. How much can you afford based on purchase price?Īside from the monthly mortgage payment (including principal and interest, taxes, insurance, and possible HOA fees), a homeowner’s budget should account for utilities, routine maintenance, and emergency repairs. These homeownership fees pay for maintenance and repairs to these spaces. HOA fees are standard in properties with common spaces, such as condominiums or neighborhoods with pools, parks and other common space amenities. The payment calculation may also include a homeowners association (HOA) dues. If the down payment amount is less than 20%, the lender may require PMI if the loan amount is more than 80% of the purchase price. Again, this is billed annually, so the calculator divides by 12 to get a monthly cost. The tax rate is based on an assessment of the property’s value. Most policies are billed annually, so the calculator divides by 12 to get a monthly cost. The loan’s monthly principal and interest can be calculated from this information. The basic mortgage calculation requires four pieces of information: Lenders typically require PMI if your down payment is less than 20% of the home’s purchase price What goes into calculating a monthly mortgage page

You can also choose to include private mortgage insurance (PMI) in your calculation. If you know the exact figures, include them for a more customized mortgage calculation. The monthly payment calculator will use estimates for your property tax rate and annual homeowners insurance.

#Mortgage calculator monthly payment plus

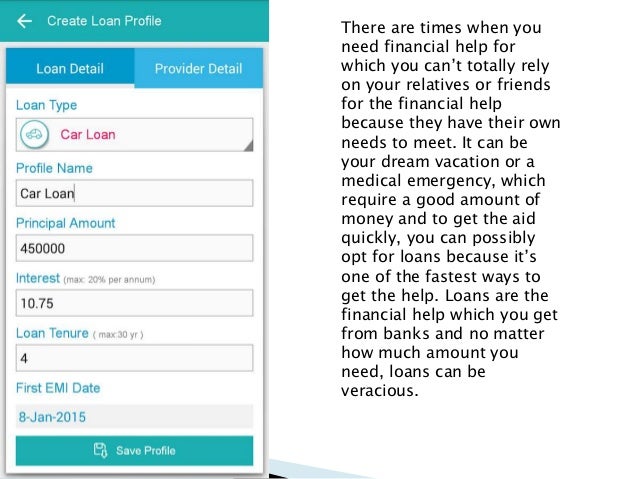

The calculator will estimate your monthly mortgage payment, including principal and interest plus taxes and insurance costs. To use our home loan payment calculator, key in some information about the home you’d like to buy and your expected loan information.

0 kommentar(er)

0 kommentar(er)